Accounts Receivable Bad Debt Journal Entry . The bad debt written off is an expense for the business and a charge is made to the income. the correct bad debt expense journal entry depends on which method you’re using. the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. This accounting entry allows a company to. Another common term used for bad debts is. journal entries for accounting receivable. the journal entry to record bad debts is: bad debt write off bookkeeping entries explained. bad debt refers to accounts receivable that a company believes it will be unable to collect payment from, and it is. The journal entry debits bad debt expense and credits. Dr bad debts expense cr allowance for bad debts.

from www.youtube.com

Another common term used for bad debts is. journal entries for accounting receivable. Dr bad debts expense cr allowance for bad debts. This accounting entry allows a company to. bad debt write off bookkeeping entries explained. The journal entry debits bad debt expense and credits. the correct bad debt expense journal entry depends on which method you’re using. the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. The bad debt written off is an expense for the business and a charge is made to the income. bad debt refers to accounts receivable that a company believes it will be unable to collect payment from, and it is.

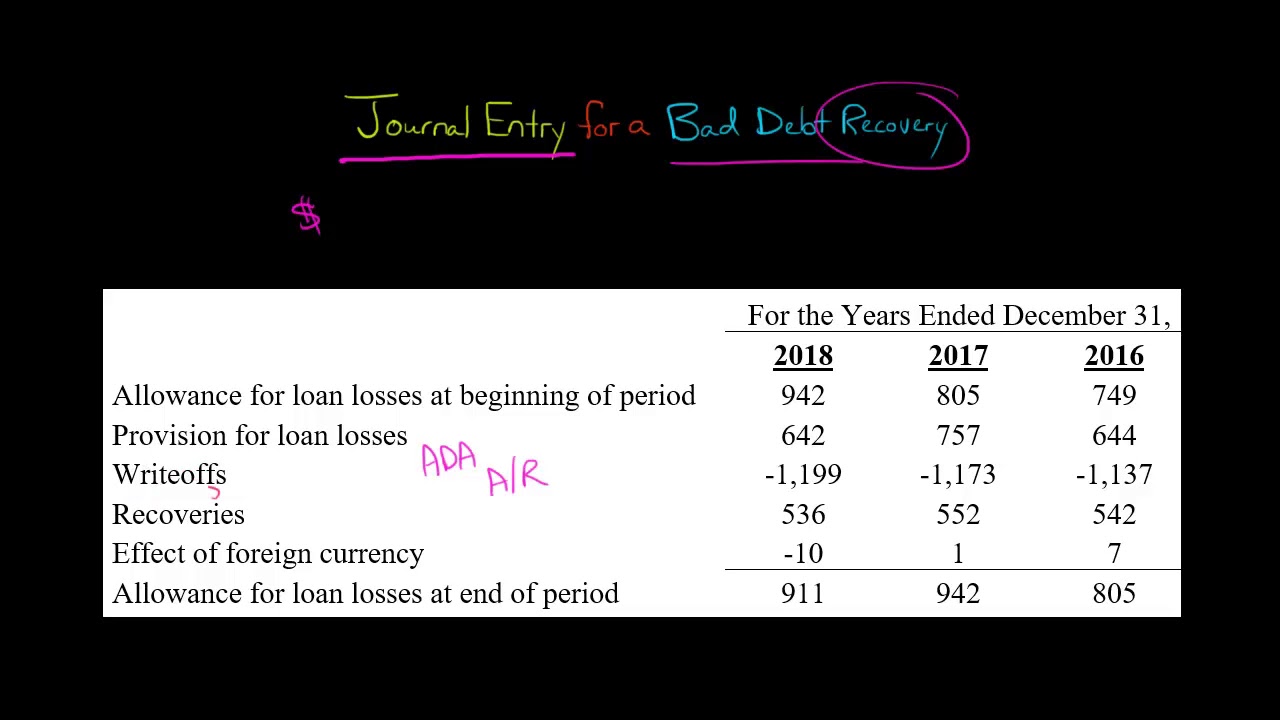

Journal Entry for a Bad Debt Recovery YouTube

Accounts Receivable Bad Debt Journal Entry the journal entry to record bad debts is: The bad debt written off is an expense for the business and a charge is made to the income. This accounting entry allows a company to. journal entries for accounting receivable. The journal entry debits bad debt expense and credits. the journal entry to record bad debts is: the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. bad debt refers to accounts receivable that a company believes it will be unable to collect payment from, and it is. Dr bad debts expense cr allowance for bad debts. Another common term used for bad debts is. bad debt write off bookkeeping entries explained. the correct bad debt expense journal entry depends on which method you’re using.

From www.youtube.com

Understand how to enter Bad Debts Recovered transactions using the Accounts Receivable Bad Debt Journal Entry The journal entry debits bad debt expense and credits. The bad debt written off is an expense for the business and a charge is made to the income. Another common term used for bad debts is. bad debt refers to accounts receivable that a company believes it will be unable to collect payment from, and it is. bad. Accounts Receivable Bad Debt Journal Entry.

From www.youtube.com

Accounting for Bad Debts Allowance Method Aging of Receivables YouTube Accounts Receivable Bad Debt Journal Entry the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. Dr bad debts expense cr allowance for bad debts. the correct bad debt expense journal entry depends on which method you’re using. bad debt refers to accounts receivable that a company believes it will be unable to collect payment from,. Accounts Receivable Bad Debt Journal Entry.

From www.youtube.com

Understand how to enter the Provision for Bad Debts transactions using Accounts Receivable Bad Debt Journal Entry the journal entry to record bad debts is: bad debt write off bookkeeping entries explained. journal entries for accounting receivable. the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. The journal entry debits bad debt expense and credits. This accounting entry allows a company to. the correct. Accounts Receivable Bad Debt Journal Entry.

From www.studocu.com

Tutorial Solutions T1 2022 Wk7 E7 Prepare journal entries for GST for Accounts Receivable Bad Debt Journal Entry Another common term used for bad debts is. journal entries for accounting receivable. This accounting entry allows a company to. bad debt write off bookkeeping entries explained. Dr bad debts expense cr allowance for bad debts. the journal entry to record bad debts is: bad debt refers to accounts receivable that a company believes it will. Accounts Receivable Bad Debt Journal Entry.

From www.youtube.com

Journal Entry for a Bad Debt Recovery YouTube Accounts Receivable Bad Debt Journal Entry Dr bad debts expense cr allowance for bad debts. the journal entry to record bad debts is: The bad debt written off is an expense for the business and a charge is made to the income. journal entries for accounting receivable. bad debt write off bookkeeping entries explained. This accounting entry allows a company to. Another common. Accounts Receivable Bad Debt Journal Entry.

From accountingmethode.blogspot.com

Bad Debt Expense Is Debited When Accounting Methods Accounts Receivable Bad Debt Journal Entry the journal entry to record bad debts is: bad debt write off bookkeeping entries explained. bad debt refers to accounts receivable that a company believes it will be unable to collect payment from, and it is. This accounting entry allows a company to. The journal entry debits bad debt expense and credits. the correct bad debt. Accounts Receivable Bad Debt Journal Entry.

From knmpaperybo.web.fc2.com

How to write off bad debt in simply accounting Accounts Receivable Bad Debt Journal Entry journal entries for accounting receivable. the journal entry to record bad debts is: the correct bad debt expense journal entry depends on which method you’re using. The journal entry debits bad debt expense and credits. Dr bad debts expense cr allowance for bad debts. This accounting entry allows a company to. bad debt write off bookkeeping. Accounts Receivable Bad Debt Journal Entry.

From www.youtube.com

Direct Write Off Recovery of Debt YouTube Accounts Receivable Bad Debt Journal Entry The journal entry debits bad debt expense and credits. Another common term used for bad debts is. the journal entry to record bad debts is: The bad debt written off is an expense for the business and a charge is made to the income. Dr bad debts expense cr allowance for bad debts. This accounting entry allows a company. Accounts Receivable Bad Debt Journal Entry.

From www.slideshare.net

Chap006 Accounts Receivable Bad Debt Journal Entry journal entries for accounting receivable. the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. the journal entry to record bad debts is: the correct bad debt expense journal entry depends on which method you’re using. The journal entry debits bad debt expense and credits. bad debt write. Accounts Receivable Bad Debt Journal Entry.

From www.accountingcapital.com

What are Bad Debts (Example, Journal Entry)? Accounting Capital Accounts Receivable Bad Debt Journal Entry the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. The journal entry debits bad debt expense and credits. The bad debt written off is an expense for the business and a charge is made to the income. bad debt write off bookkeeping entries explained. Dr bad debts expense cr allowance. Accounts Receivable Bad Debt Journal Entry.

From bcom-ku.blogspot.com

ACCOUNTS RECEIVABLE AND ALLOWANCE FOR BAD DEBTS PART 3 Accounts Receivable Bad Debt Journal Entry The journal entry debits bad debt expense and credits. the correct bad debt expense journal entry depends on which method you’re using. bad debt write off bookkeeping entries explained. Dr bad debts expense cr allowance for bad debts. the journal entry to record bad debts is: The bad debt written off is an expense for the business. Accounts Receivable Bad Debt Journal Entry.

From www.youtube.com

Journal Entries for Bad Debts and Bad Debts Recovered YouTube Accounts Receivable Bad Debt Journal Entry the correct bad debt expense journal entry depends on which method you’re using. This accounting entry allows a company to. The journal entry debits bad debt expense and credits. the journal entry to record bad debts is: bad debt refers to accounts receivable that a company believes it will be unable to collect payment from, and it. Accounts Receivable Bad Debt Journal Entry.

From www.youtube.com

Understand how to enter Bad Debts transactions using the Double Entry Accounts Receivable Bad Debt Journal Entry the correct bad debt expense journal entry depends on which method you’re using. bad debt refers to accounts receivable that a company believes it will be unable to collect payment from, and it is. journal entries for accounting receivable. The bad debt written off is an expense for the business and a charge is made to the. Accounts Receivable Bad Debt Journal Entry.

From www.chegg.com

Solved esti The following journal entry Account Accounts Accounts Receivable Bad Debt Journal Entry Dr bad debts expense cr allowance for bad debts. bad debt write off bookkeeping entries explained. the correct bad debt expense journal entry depends on which method you’re using. The bad debt written off is an expense for the business and a charge is made to the income. Another common term used for bad debts is. the. Accounts Receivable Bad Debt Journal Entry.

From filmmary18.gitlab.io

Beautiful Provision For Bad Debts In Statement Cash Flow Balance Accounts Receivable Bad Debt Journal Entry bad debt write off bookkeeping entries explained. The journal entry debits bad debt expense and credits. the correct bad debt expense journal entry depends on which method you’re using. bad debt refers to accounts receivable that a company believes it will be unable to collect payment from, and it is. Dr bad debts expense cr allowance for. Accounts Receivable Bad Debt Journal Entry.

From dfaysucleco.blob.core.windows.net

What Is The Journal Entry For Creating A Provision For Bad Debts at Accounts Receivable Bad Debt Journal Entry The bad debt written off is an expense for the business and a charge is made to the income. Another common term used for bad debts is. bad debt write off bookkeeping entries explained. the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. Dr bad debts expense cr allowance for. Accounts Receivable Bad Debt Journal Entry.

From www.double-entry-bookkeeping.com

Bad Debt Write Off Journal Entry Double Entry Bookkeeping Accounts Receivable Bad Debt Journal Entry Dr bad debts expense cr allowance for bad debts. the correct bad debt expense journal entry depends on which method you’re using. journal entries for accounting receivable. the bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers. bad debt write off bookkeeping entries explained. The journal entry debits bad. Accounts Receivable Bad Debt Journal Entry.

From mybillbook.in

What is Bad Debts Journal Entry Accounts Receivable Bad Debt Journal Entry the journal entry to record bad debts is: the correct bad debt expense journal entry depends on which method you’re using. The bad debt written off is an expense for the business and a charge is made to the income. bad debt write off bookkeeping entries explained. Dr bad debts expense cr allowance for bad debts. The. Accounts Receivable Bad Debt Journal Entry.